A month and a half ago I sold my position down to 25% long and have been waiting for the correction to run its course. If my theory that the market is in a major leg up is correct then it is time to look at the charts again.

HUI

It has been 25 trading days since the top has been put in in gold stocks. That is 62% of the last rally which lasted for 40 days. The price is approaching the 35-39 echo and is on a 16-20 buy signal. The 16-20 buy is 12 days old and is 2% in profit which is appropriate for the bullish picture. The 35-39 should prove to be the main support. In a true bull environment this would be the time for the price to start moving up. It doesn't have to be an explosive move but the bottom should be in or reached in the next few days.

GLD

The 35-36 is being touched while 221 is buying. The $165 level was the breakout and is now being tested. If successful it should signal the next leg up.

SLV

This was the most important chart to identify the change in direction and the potential of the last big market rally. The 32 level was the breakout level into the bull market. In the current picture this level and its importance is represented by confluence of three important indicators:

-the 35-39 echo that has just sold at 31.27. This should represent the support.

-the 221 echo that has bought 2 days ago. This buy has a proper bullish alignment and also should represent the support.

-the long term support/resistance trend line (red) that is currently standing at around 32. Since its inception the SLV is oscillating around this trend line and every significant move up or down has started by confirming breakout or breakdown of this line. You can see how the recent true bull signal coincided with breaking through this trend line and how it is being tested now.

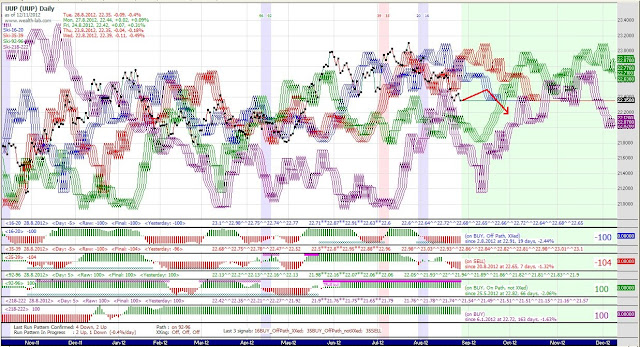

UUP

My last update was titled 'Has dollar bottomed?' and yes indeed that was the bottom. The ensuing rally was week and not what I was going for. I would be happier with a sharp move straight into the 16-20 sell and then a 221 sell for a double sell and then a strong continuation of the down trend. The way it has transpired it is not quite sure that the correction is over, e.g. we might be looking at a double bottom. If that is the case the question is how to reconcile this with the the HUI and the GLD chart? My take would be more sideways/down for the GLD and a relative strength in gold stocks (sideways).

SandP

SandP is on a true bull and is testing the breakout. It is down to touch/break the 35-39 echo which should prove to be the support if this is really beginning of a move up.

Aussie gold

Aussie golds confirmed the bottom after buying the 92-96 echo. The bottom was in the form of an inverse H&S and is now testing the neckline level from above. I am beginning buying at this level. Bought this week EVN, RSG, OGC and KCN to get back to 50% invested. I will be adding on weak days until fully invested. No stop loss for now.

.jpg)