The price action during Thursday session and the Friday session in Asia/Europe was in line with negative signals generated at the beginning of the week but by the time the USA market opened the things have turned around. Many signals have been reversed and right now it seems like the last week action was a fake-out.

In the week before Christmas, I wrote that "I would prefer a slow action, the wall of worry type, instead of a quick spike. I think that this would give us a more sustainable breakout sometime between the first week of January and the first week of February 2021". When I said I preferred a slow action I really didn't mean this slow but here we are, the first week of February is over and it seems we just barely made it, like in the last hour of the last day! If the slower means better this is as good as it gets. Having said that, we still need a follow-through next week to confirm the breakout.

In the last hour of trading on Friday, I have established some initial positions in silver and gold in the FOREX market. My dollar position was taken out by a stop loss for a small profit. Next week, if no more surprises, I will start buying my trading positions back.

Let's see the charts

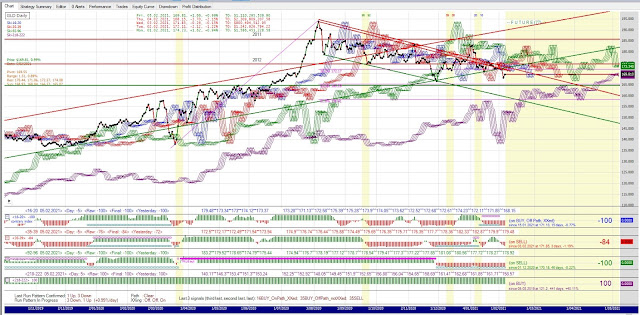

USERX

USERX price has been oscillating around the green uptrend line since the November low. After a double fake-out, it has generated the 35-39 buy signal that together with the current 16-20 buy signal constitutes a bullish JPOT buy. The energy released by this buy signal should push the price further towards the 92-96 buy signal to complete a powerful double 35-39/92-96 buy.

If the above scenario transpires, the momentum needs to be sustained at least till the first week of March. This is because there will be a period of two weeks while any prolonged weakness will lead to a double sell. Also, at the end of February, there is a small spike in the back prices which could lead to a quick sell/buy sequence that has the potential to transform current signals into a true bull signal. If it comes to this point it is again the best strategy to ignore these signals as long as the price stays inside the uptrend channel.

HUI

I've been writing about the importance of the HUI $286 price area since early December. This is the area that was broken through in 2013 and also has marked the 2016 high before continuing years-long consolidation. Guess what, after dropping intraday on Thursday all the way to 273.1, on Friday price reversed and closed at $286.63! I hope this is the farewell touch before the lift-off. The HUI price needs to be over $330 to generate the double buy and I doubt it will happen in the next two weeks. On the other hand, the potential 92-96 buy signal is almost warrantied to be transformed into a true bull signal along the way. The only way this will not happen is if the price explodes to $350 in the next two weeks and then keeps rising.

XAU

same as USERX but better. It has never seriously violated the uptrend. Even staying at the current level will produce the 92-96 buy signal in a few days.

GDX

GDXJ

GLD

GLD suffered from the last week 35-39 sell signal but it seems that it has found the support on Friday. Any further weakness would be a signal that something is very wrong. It is very important that GLD buys back the 35-39 and clears the overhead resistance. The first resistance for gold is around $1825-1830, that area is the neckline area of the head and shoulders pattern on 1h chart that was broken on Thursday. The next resistance is at $1860 the area that has been rejected many times in the last two weeks.

For now, it is ok that gold is lagging miners because it usually does at turnarounds but any weakness that is not temporary would be a problem in the next 5 days.

SLV

The SLV chart is the best looking chart of all precious metals right now. The price just generated a true bull signal which should mark the start of a long term rise. This signal has all the characteristics of a proper bull setup and if everything works out as it should I expect silver to catch up with gold and hit a new all-time high during this leg up.

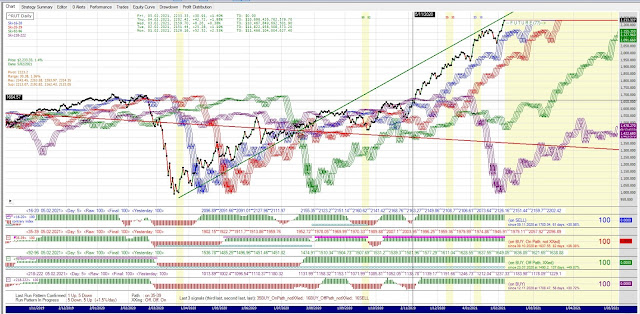

S and P 500

After touching the 16-20 echo the price of S and P bounced back and is at the new all-time high again. It seems that it is heading above $4000, as projected by the break of the cup and handle formation back in July 2020.

I'll add the chart of Russell 2000 to illustrate that since Biden has been elected the main action has moved from the internet and tech companies to wider USA domestic market. The Russell 2000 is up 34% since the election day.

TRAN - transport index ETF

Transport index recovered from the bearish double sell and is again above the necessary level to start the new leg up and confirm the bull market in Dow and SandP. The trend is intact but this time chart doesn't have the weaknesses that it had back in January.

UUP - dollar ETF

UUP bullishly bought the 35-39 echo above the resistance but it showed some serious weakness on Friday. Nothing has been reversed yet but it will be if the weakness continues. I'd personally like to see it reach the 92-96 echo before turning around because, if the gold does the same, that would be a potent fuel for the Aussie golds to catch up with the American counterparts.

As I said last time this chart looks bad. The bonds continue the fall and the price is currently almost as low as at the March bottom. The price turned down in August around the same time as the gold and we might now need a trend change again for the gold to finally bottom. The current price pattern is 1 up 7 down. I do not have a longer-term stats but the last two times that 1up 5+down pattern was formed it did mark the exact June 2020 low and the exact Aug 2020 high. Hopefully this time it will mark a trend change again.

Bitcoin

The 16-20 buy marked the exact bottom 17 days ago and on Friday the price generated a 16-20 sell. We will see if this signal is going to stop the rise and lead to touch/sell of the 35-39 echo which is now on the 116 days long buy signal. I think the odds are good for an interaction with the 35-39.

It seems that, after all the drama, the price targets for the renewed precious metals bull market will be achieved but we still need, this week, all the necessary confirmation signals to be generated.

I have started accumulating FOREX positions for silver and gold and will start buying back my trading positions in Aussie stocks next week.

For now, the stop loss is USERX 35-39 sell signal.

Good luck everyone.

Branko

No comments:

Post a Comment