SLV

Two days before the SP500 generated its 92-96 true buy signal the SLV generated its true 35-39 signal. This signal came as a result of a failed 16-20 sell while overcoming a long term resistance from the April 2011 top and, also very important, while being on a bearish 92-96 sell that couldn't produce any downside. I concluded that it seems the resistance has been broken and the odds are that the SLV is going to accelerate north. The odds worked favourably and SLV moved up almost 9% since then. I expect it to move further up to over 30 and stay there for a 92-96 buy signal.

SP500

The other option is that precious metals are disconnecting from the SP500 and they will rally while the SP500 is going into a dive. Considering the state of the dollar chart I think that this option is less probable.

GLD

The GLD has bought the 92-96 and has reached the April down trend line at the same time. It is trying to break out and it will if it closes above 162. However , it doesn't have to happen straight away, a steady sideways move for up to two weeks will do the trick. Selling and buying back the 92-96 along the way would be just perfect.

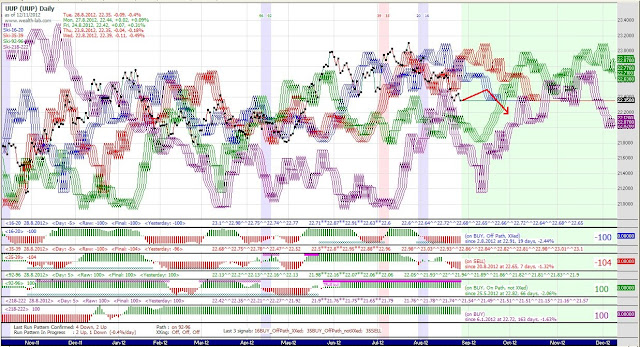

UUP

For 65 days from its inception the UUP true bull 92-96 buy didn't manage to produce any decent upside. The 16-20 buy failed twice, same as 35-39 buy. This is not confirming behaviour and I expect this chart to drop further to test the 92-96 support. In the short term (2-3 weeks) it could go sideways/up to touch the 16-20 from the downside before it resumes sliding down.

HUI

The stage three of a true bull set-up has been achieved for the HUI, the 92-96 buy. There is a disclaimer though, beside coming very close to it it couldn't clear June high of 464.76 but I expect it to be done in the next couple of days.

The HUI setup is a bit different when compared to the SLV and the GLD.The SLV clearly broke out of its May 2011 top down-trend but it has to go further to reach the 92-96 echo before it can try to break free.

The GLD has reached the down trend line and the 92-96 echo simultaneously and trying to break out. It has bought the 92-96 but still needs to close over 162 to break the trend line. It would be nice to see it happen in the first two weeks of September.

The HUI, on the other hand, bought the 92-96 but is still far away from its down trend line which is positioned around 485. I think that proper positioning for the HUI break out requires it to reach this 485 level before a serious consolidation takes place. This resistance line should then stop the advance until the next 16-20 buy signal comes into the picture. The scenario that we should be cautious about is if we go strait down for the next ten days to below 422.47 without breaking 464.76. In this case there is a good chance we would get a double 16-20/92-96 buy but that will open a serious possibility for a triple sell next time we reach HUI 450. I don't like this possibility because structurally it is bearish.

The conclusion is that once the HUI 465ish has been broken it will confirm that the initial leg up out of the bottom was an impulsive wave. That is in accord with the premise that the May low is a long term low. The ensuing long term rally should last at least 710 trading days.

On the premise that this leg up should set the stage for a gold bull I think that the HUI has some unfinished business around 485. For that reason I am still 50% long. I have restructured the holdings to get rid of shares that reached the targets and replaced them with those with more potential. If I am wrong and we go straight down to 16-20 buy I will sell when we reach the current level again and then wait to see if we are going to avoid a possible triple sell. If I am right I will reduce my position to 25% long at HUI 485 (optimally 495.70) and wait for the 16-20 buy to go long 100%.